Best ETFs for 2025:

Where to Invest Your Money for Growth

Exchange Traded Funds (ETFs) have been gaining massive popularity among investors over the last decade. Why? They offer diversification, ease of trade, and often lower costs compared to mutual funds. For both seasoned investors and beginners, ETFs represent an excellent opportunity to grow wealth.

Looking ahead to 2025, the ETF market is expected to see robust growth, as innovations and sector trends continue to shape investor demand. If you’re looking to maximize your returns, it’s essential to focus on the best ETFs that align with your investment goals. This article will guide you through everything you need to know, from selection criteria to some expert picks for 2025, and helpful tips on investing wisely in ETFs.

Why ETFs Are a Growing Favorite Among Investors

ETFs combine the best of stocks and mutual funds—offering the flexibility of trading like a stock while providing the diversification of a mutual fund. Over the years, they’ve evolved from broad-market trackers to niche funds focused on specific sectors, geographies, or investment strategies like ESG (Environmental, Social, and Governance).

Their benefits include:

- Diversification: ETFs can hold hundreds or thousands of assets, reducing your overall risk.

- Lower Costs: With expense ratios often below 0.10%, ETFs are much cheaper than mutual funds.

- Accessibility: They’re easily tradable on major stock exchanges, just like individual stocks.

- Transparency: Most ETFs disclose their holdings daily, offering greater visibility for investors.

With $10+ trillion already invested in ETFs globally, they’re quickly becoming the go-to tool for growing wealth.

How to Choose the Best ETFs for 2025

Finding the top ETFs for 2025 requires careful consideration across several dimensions. Here are key criteria to keep in mind when building your portfolio:

- Performance History

While past performance isn’t a predictor of future returns, it’s still useful to examine an ETF’s track record. Look for funds that have demonstrated consistent performance, especially during volatile markets.

- Expense Ratios

High expense ratios can eat into your returns over time. Focus on Best ETFs with low management fees—ideally under 0.15% annually.

- Sector Allocation

Consider which sectors are expected to perform well in the coming years. For example, clean energy and AI technologies are expected to dominate as governments and industries prioritize sustainability and innovation.

- Underlying Assets

Check the Best ETFs holdings. Does it align with your investment goals? Diversification across industries and geographies is essential for reducing risk.

- Liquidity

Highly liquid ETFs are easier to trade. Look for funds with high average daily trading volume and narrow bid-ask spreads.

By using these filters, you can streamline your options and focus only on the Best ETFs that truly present growth opportunities for your portfolio in 2025.

Top 5 Best ETFs to Watch in 2025

Here are five ETFs that stand out based on their growth potential, diversification, and exposure to trending sectors:

1. ARK Innovation ETF (ARKK)

- Focus: Disruptive technologies

- Performance: Known for high-growth potential, ARKK invests in cutting-edge industries like AI, genomic research, and fintech.

- Why It Shines: With rapid advancements in areas like AI and blockchain technology, this ETF is poised for long-term gains.

- Expense Ratio: 0.75%

2. Vanguard S&P 500 ETF (VOO)

- Focus: Broad market exposure

- Performance: Tracks the S&P 500 Index, making it one of the safest bets for long-term stability.

- Why It Shines: Ideal for investors seeking steady, diversified growth.

- Expense Ratio: 0.03%

3. iShares Global Clean Energy ETF (ICLN)

- Focus: Renewable energy

- Performance: Offers access to companies leading the renewable revolution.

- Why It Shines: With governments around the world committing to net-zero emissions, clean energy ETFs like ICLN are positioned for growth.

- Expense Ratio: 0.42%

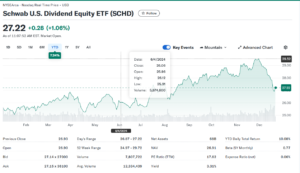

4. Schwab U.S. Dividend Equity ETF (SCHD)

- Focus: High-dividend, quality stocks

- Performance: Targets stable companies with consistent dividend payouts.

- Why It Shines: Perfect for income-focused investors wanting low-cost exposure.

- Expense Ratio: 0.06%

5. Global X Robotics & Artificial Intelligence ETF (BOTZ)

- Focus: Robotics and AI companies

- Performance: Offers exposure to leading innovators in automation and AI.

- Why It Shines: This high-growth sector is expected to expand significantly in the coming years as industries become increasingly automated.

- Expense Ratio: 0.69%

These ETFs represent a diverse mix of sectors—perfect for building a well-rounded portfolio capable of tackling market shifts in 2025.

How to Invest in Best ETFs Like a Pro

Once you’ve identified the ETFs you want to invest in, the actual investment process is simpler than you might think. Here’s how to get started:

- Open a Brokerage Account

Choose a platform like Vanguard, Fidelity, or Robinhood to access a variety of ETFs. Look for features like zero-commission trading and user-friendly interfaces, especially if you’re a beginner.

- Research and Compare

Use ETF screeners to analyze different funds based on their performance, expense ratios, and holdings.

- Buy Your ETF Shares

Enter the ETF’s ticker symbol (e.g., “VOO” for Vanguard S&P 500 ETF) and specify how many shares you want to purchase. You can also set up recurring investments to grow your portfolio steadily.

- Diversify Your Portfolio

Avoid putting all your money into one or two ETFs. Spread your investments across multiple sectors and markets to minimize risks.

- Monitor and Rebalance

Periodically review your holdings. If certain ETFs outperform or underperform, consider rebalancing your portfolio accordingly.

The Future of ETFs

The ETF market continues to expand with new funds tailored to emerging trends. Here’s what experts predict for the future:

- Thematic ETFs will grow in popularity as investors seek niche exposure in sectors like space exploration, AI, and biotechnology.

- Sustainability-Focused Funds will dominate, driven by increased demand for ESG investing.

- Automation and AI will further reduce ETF management costs, making them even more accessible.

- Active ETFs will challenge traditional passive strategies, offering actively managed exposure to high-growth stocks.

ETFs are not just tools for today—they’re the future of investment. Staying informed and aligning your portfolio with market shifts will keep you ahead of the curve.

Take Action Today

Investing in the best ETFs in 2025 could be a game-changer for your financial goals. With their low costs, diversification, and potential for growth, ETFs are an excellent option for building long-term wealth.

Want to stay ahead in your investment game? Subscribe to our newsletter for expert tips, top ETF picks, and market trends delivered straight to your inbox.

Common Mistakes to Avoid When Investing in ETFs

While ETFs are an excellent tool for growing wealth, certain pitfalls can hinder your success if not addressed carefully. Here are some common mistakes investors make and how to avoid them:

- Overlooking Expense Ratios

Even though ETFs are known for their low costs, not all funds are created equal. Higher expense ratios can eat into your profits over time, especially for long-term investors. Always opt for funds with competitive costs that align with your investment strategy.

- Chasing Performance

It’s tempting to invest in ETFs that have recently outperformed the market, but past performance is not always indicative of future results. Instead of chasing returns, focus on long-term fundamentals such as diversification, underlying assets, and sectors with strong growth potential.

- Neglecting Diversification

Placing all your investments in a single ETF or sector exposes you to unnecessary risks. Diversify across industries, regions, and asset classes to spread out risk and improve the resilience of your portfolio.

- Timing the Market

Trying to buy or sell ETFs based on market peaks and troughs can be risky and counterproductive. Instead, adopt a disciplined approach, such as dollar-cost averaging or regular, periodic investments, to reduce the impact of short-term volatility.

- Ignoring Tax Implications

While ETFs are generally tax-efficient, selling shares at a profit or investing in funds that frequently rebalance can trigger taxes. Be mindful of capital gains and consult a tax advisor to optimize your strategy.

Avoiding these common errors can help you maximize your ETF investment returns and maintain a sustainable portfolio over the long term.

Resources to Enhance Your ETF Knowledge

Expanding your understanding of Best ETFs and staying informed about market updates can make a significant difference in your investing success. Here are some resources to consider:

- Financial News Platforms

Websites like Bloomberg, CNBC, and Morningstar offer regular updates on ETF performance, market trends, and expert insights.

- ETF Screeners and Tools

Platforms like ETFdb and Seeking Alpha provide detailed comparisons of different funds based on expense ratios, holdings, and performance metrics.

- Investment Books and Courses

Books such as “The Little Book of Common Sense Investing” by John C. Bogle offer timeless advice on index funds and Best ETFs . Online courses on platforms like Coursera or Udemy can also give you practical strategies for ETF investing.

- Podcasts and Webinars

Tune into podcasts like “We Study Billionaires” or attend investment webinars hosted by financial institutions to learn from industry leaders.

The more you educate yourself, the more empowered you will be to make informed decisions that align with your financial goals.

Tips for Starting Your ETF Investment Journey

If you’re new to ETF investing, beginning your investment journey with confidence can set you up for long-term success. Here are some actionable tips to help you get started effectively:

- Define Your Goals

Before investing, identify your financial objectives. Are you saving for retirement, building an emergency fund, or growing wealth for a major purchase? Your goals will help determine the type of ETFs that best suit your strategy.

- Understand Your Risk Tolerance

Assess how much risk you’re willing to take based on your financial situation and investing timeline. For example, broad market ETFs like the S&P 500 are generally considered less volatile, while sector-specific ETFs might carry greater risk but offer higher growth potential.

- Start Small

You don’t need a large amount of capital to begin. Many brokerage platforms allow you to purchase fractional shares, enabling you to invest in high-priced ETFs for as little as $10. Starting small also allows you to learn and adapt as you go.

- Choose the Right Platform

Select a brokerage that offers an easy-to-use platform, low fees, and access to a variety of ETFs. Look for features like commission-free ETF trading and educational resources to support your learning process.

- Track Your Progress

Once you’ve begun investing, periodically review how your ETFs are performing relative to your goals. Use portfolio tracking tools to monitor returns, diversification, and risk exposure. Adjust your portfolio as needed to stay aligned with your objectives.

By following these tips, novice investors can gain confidence in navigating the world of ETFs while building a solid foundation for their financial future.

Advanced Strategies for Best ETFs Investors

Once you’ve mastered the basics, exploring advanced ETF strategies can further enhance your portfolio’s performance. These strategies require a deeper understanding of the market and careful consideration, but they can offer significant benefits for experienced investors.

- Leveraged and Inverse ETFs

Leveraged ETFs aim to amplify the returns of an underlying index, while inverse ETFs are designed to perform in the opposite direction of the market. These tools can be effective for short-term speculative trades, but they are not recommended for long-term investors due to their higher risk and potential for significant losses.

- Thematic Investing

Thematic ETFs focus on specific trends or sectors, such as clean energy, artificial intelligence, or emerging markets. By identifying growth themes aligned with your investment thesis, you can position your portfolio to capitalize on future opportunities. However, ensure you diversify to avoid overexposure to a single theme.

- Tax-Loss Harvesting with Best ETFs

Tax-loss harvesting involves selling underperforming Best ETFs to realize losses, which can be used to offset capital gains and reduce your tax liability. After selling, you can reinvest in similar ETFs to maintain exposure to your desired asset class or sector. This strategy requires careful timing and planning with a tax professional.

- Pairing Best ETFs with Other Assets

Combining Best ETFs with individual stocks, bonds, or mutual funds can provide additional layers of diversification and flexibility. For example, dividend-focused ETFs can complement growth stocks in creating a balanced portfolio with both income and capital appreciation potential.

- Using Options on ETFs

Experienced investors can explore options trading with ETFs, such as covered calls or protective puts, to hedge against risks or generate additional income. While options offer flexibility, they also carry complexity and require a solid understanding of derivatives.

By incorporating these advanced strategies, seasoned ETF investors can fine-tune their portfolios to achieve specific financial objectives while navigating varying market conditions with confidence.

Other Usefull Articles :

10 Best State Farm Quantum Computing Jobs & Careers in Data Analysis